A Break-even Analysis Graph Contains Which of the Following

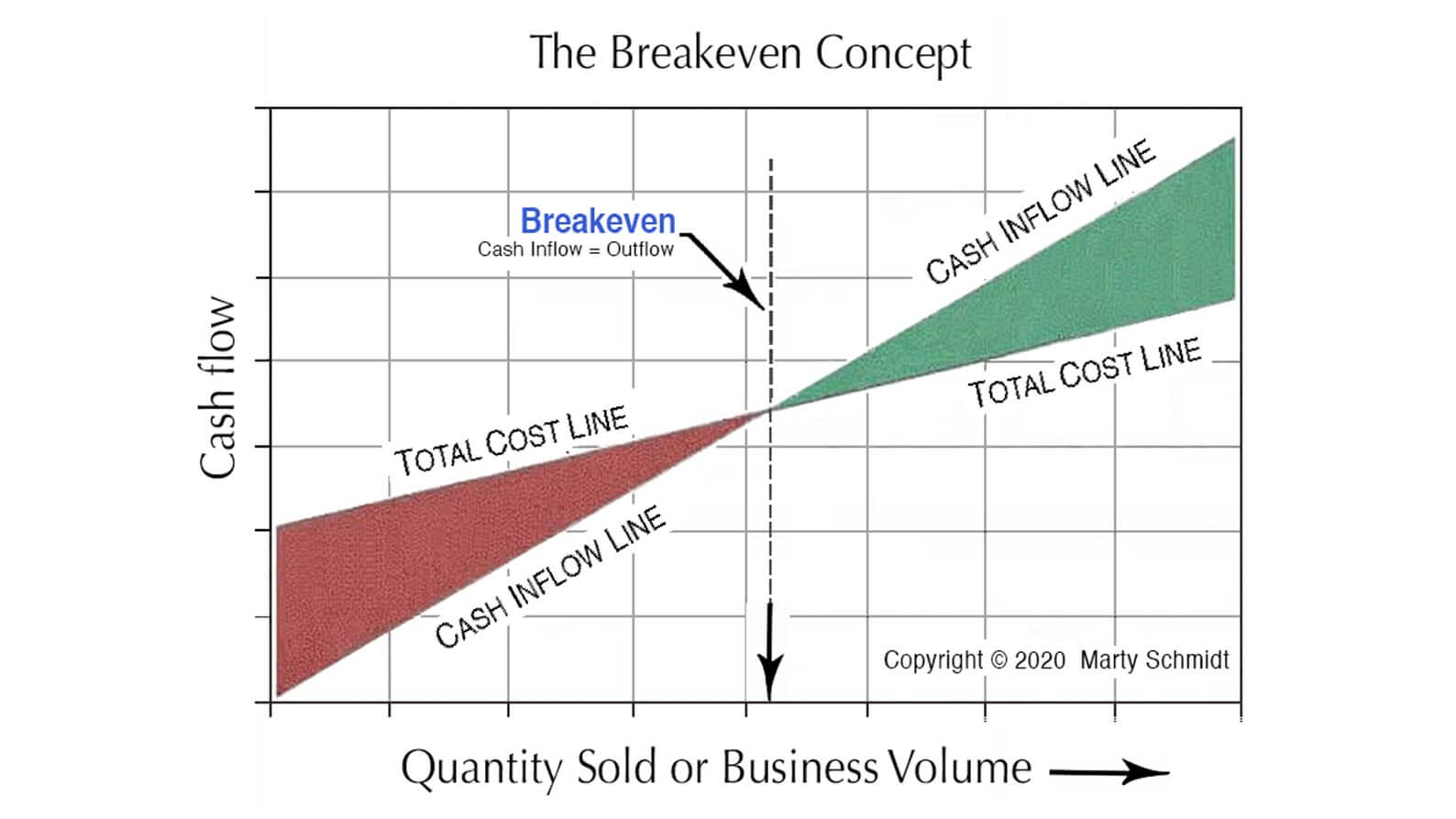

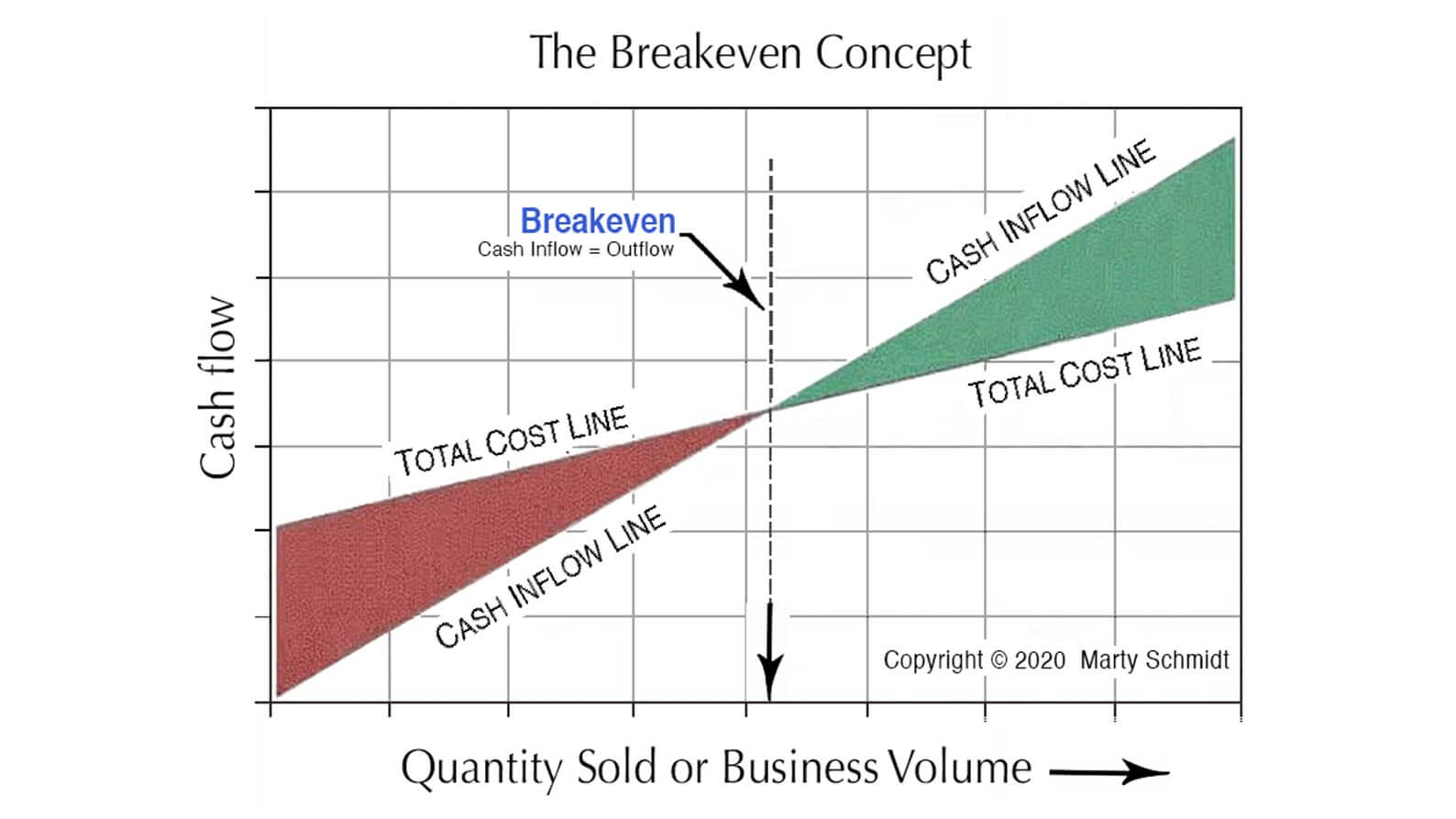

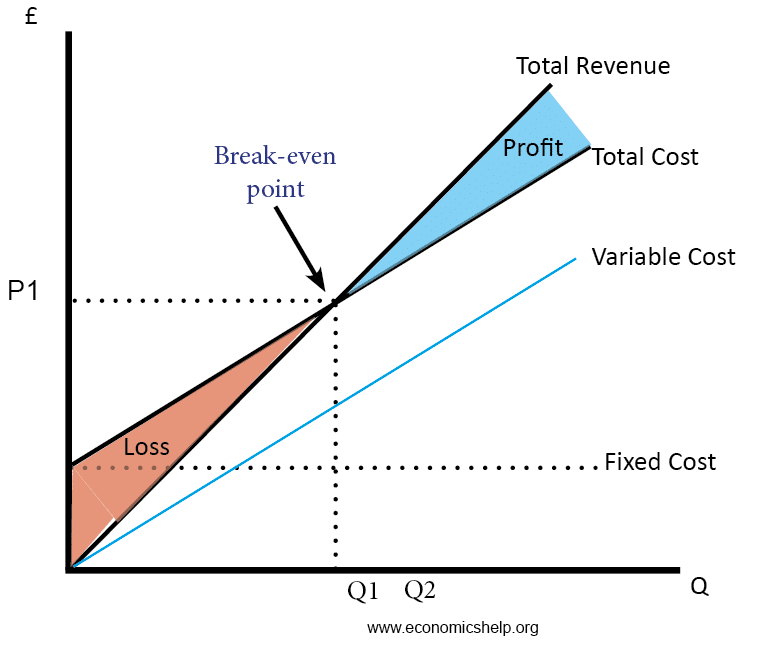

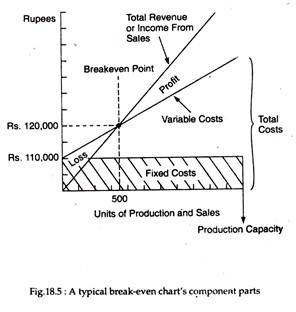

BREAK EVEN ANALYSIS GRAPH. The Break-even analysis or cost-volume-profit analysis c-v-p analysis helps in finding out the relationship of costs and revenues to output.

Find Break Even Point Volume In 5 Steps From Costs And Revenues

A break-even analysis is an economic tool that is used to determine the cost structure of a company or the number of units that need to be sold to cover the cost.

. QUESTION 7 Which of the following statements is correct with regard to a CVP Cost Volume Profit graph. Break-even analysis is a method of studying the relationship among sales revenue variable cost and fixed cost to determine the level of operation at which all the costs are equal to its sales revenue and it is the no profit no loss situation. Construct a break-even chart showing the break-even point and the margin of safety at present.

Plot the following data on a graph break-even chart and determine. Break-even analysis is an important aspect of a good business plan since it helps the business determine the cost structures and the number of units that need to be sold in order to cover the cost or make. Volume of productionoutput or sales is plotted on horizontal axis ie X-axis.

C Cash Break-Even Chart. Cost Volume and Profit which explores the relationship existing amongst Costs Revenue Activity Levels and the resulting Profit. Operating leverage is a measure of how sensitive net operating income is to a given percentage change in dollar sales c.

At both the points there is neither profit nor loss. Break Even Analysis Varies. A company has fixed costs of 300000 and produces one product with a selling price of 7200 and a variable cost of 4200 per unit.

This is an important technique used in profit planning and managerial decision making. Break-even is a circumstance where a company neither makes a profit nor loss but recovers all the money spent. It is also known as Cost Volume Profit Analysis.

The break-even analysis is used to examine the relation between the. Output data which generates break-even chart Displays break-even point variable costs fixed costs Entry screen for fixed and variable costs pricingcontribution The chart sheet is one of the two report sheets in this tool. The maximum factory capacity is 20000 units and it anticipates selling 15000 units.

The break-even point formula is calculated by dividing the total fixed costs of production by the price per unit less the variable costs to produce the product. In Figure 212 the point at which TR equals TC point Q. Break even Analysis is the analysis of three variables viz.

To add the Break-even point to the chart it is necessary to have both BEP in sales volume and BEP in sales dollars values. A Break-even point b Profit if the output is 25000 units. The following graph explains all the concepts used to find out the break even point.

Explain to students that this graph is used to provide a graphical representation of the breakeven point. The break-even point is the level of sales at which the total sales dollar amount equals the total fixed costs. Show Slide 3 the break-even graph.

Sales price per unit is the selling price unit selling price per unit. At the break-even point profits on the sale of a product are. - algebraic statements of the revenue function and the cost function - a detailed break - even graph - computation of the break - even point in units as a percent of capacity and in sales dollars a Engineering estimates indicate the variable cost of manufacturing a new product will be 35 per unit.

Break-even analysis examines the relationship between which of the following price profit cost. 2A CVP graph shows the break-even point as the intersection of the total sales revenue line and the total expense line 3A CVP graph assumes that total expense varies in direct proportion to unit. Break-even analysis uses a calculation called the break even point BEP which provides a dynamic overview of the relationships among revenues costs and profits.

A break-even analysis gaph contains which of the following. The break-even point is the point where total revenue total cost or price per unit cost per unit. If you chose to calculate the number of months before you reach break.

In Business or Economics the Break Even Point BEP is the point at which the total of fixed and variable costs of a business becomes equal to its total revenue. Under this method following steps are taken to draw the break-even chart. At this point a business neither earns any profit nor suffers any loss.

Level along with total fixed and variable costs. The price minus the variable cost per unit is known as. BreakEvenAnalysis NikolaosTsorakidisSophoclesPapadoulosMichaelZerres ChristopherZerres Downloadfreebooksat Introducti.

More specifically it looks at a companys fixed costs in relation to profits that are earned from each unit sold. Add the Break-even point. In Figure 211 the firm breaks even at two different points B and B.

Before preparing a Cash Break-Even Chart we are to divide the amount of fixed cost into two following groups. Three lines marked as a b and c can be noticed on. The breakeven chart consists of an ordinate y-axis and an abscissa x-axis.

View Notes - break-even-analysis from ECONOMICS STAT203 at Beirut Arab University. This analysis is usually presented on a break-even chart. Break-Even Analysis vs.

Formula for Break Even Analysis. Ii Fixed Cost which do not require immediate cost like Deferred Expenditure Depreciation etc. Margin of safety is the excess of budgeted or actual dollar sales over the break-even dollar sales.

The abscissa can be dimensioned in terms of the production volume ie number of units produced. It enables the financial manager to study the general effect of the level of output upon income and expenses and therefore upon profits. The ordinate presents a scale of rupees against which fixed costs variable costs and rupees of revenue can be measured.

Fully label your diagram. ACCORDING TO CHARTERED INSTITUTE OF MANAGEMENT ACCOUNTANTS LONDON. Fixed costs are costs that do not change with varying output eg salary rent building machinery.

1A CVP graph shows the maximum possible profit. For each of the following perform a break - even analysis showing. I Fixed Cost which require cost outlay like Rent Salary etc.

Break even point in units Fixed Costs Sales price per unit Variable Cost per Unit. Break-even analysis is a business tool widely used across all industries to evaluate business performance in terms of costs since this is a supply-side analysis. Add the new data.

Break even quantity Fixed costs Sales price per unit Variable cost per unit Where. The Break-even point in sales volume was calculated above C8 The Break-even point in sales dollars can be calculated using the following formula. The formula for break even analysis is as follows.

Line A represents the sales dollars revenue that are generated through sales of the good or service and line B represents the costs that are associated with production of the good or service. Total costs fixed costs total revenue.

Break Even Price Economics Help

No comments for "A Break-even Analysis Graph Contains Which of the Following"

Post a Comment